Small scale energy infrastructure

Business Model Description

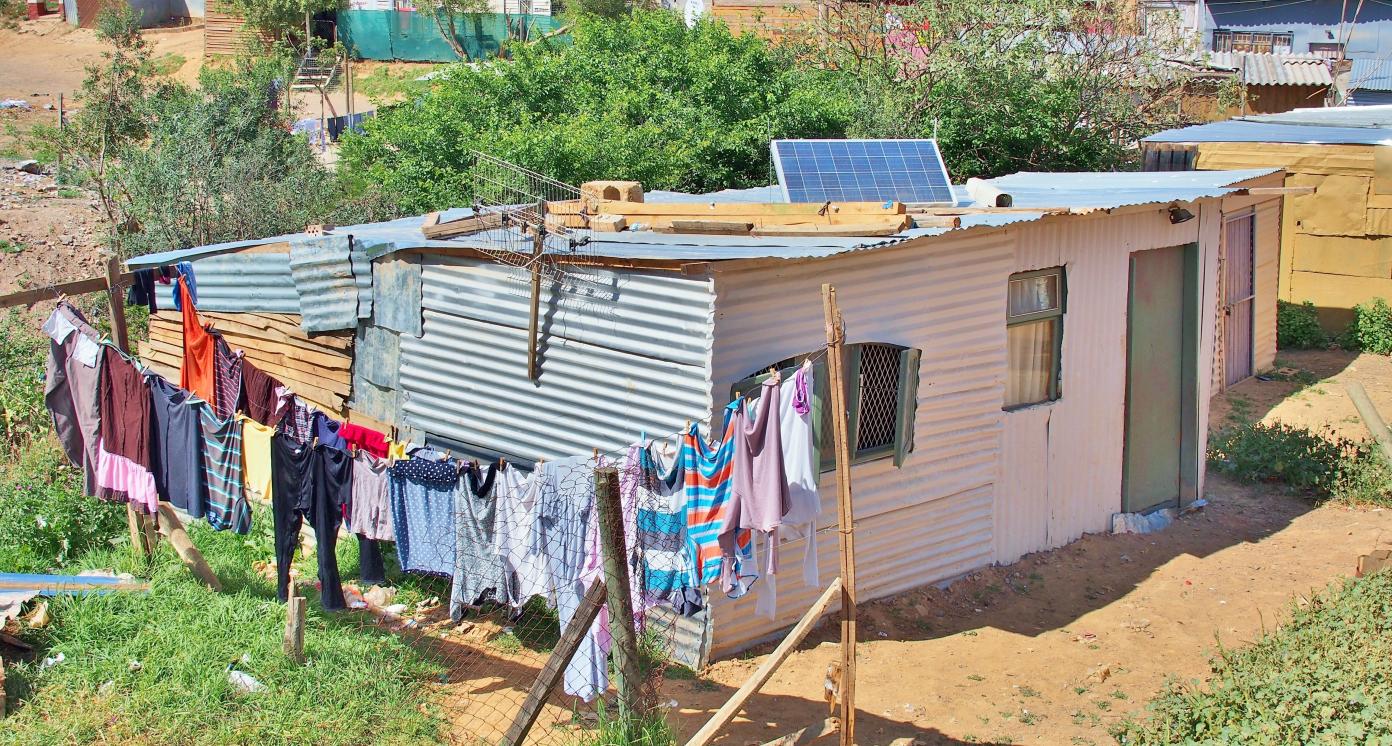

Provide small scale renewable energy infrastructure to promote access to underserved communities, such as rooftop photovoltaic (PV) systems or off-grid hydrogen generators.

Expected Impact

Improve access to clean energy and provide energy security in rural areas.

How is this information gathered?

Investment opportunities with potential to contribute to sustainable development are based on country-level SDG Investor Maps.

Disclaimer

UNDP, the Private Finance for the SDGs, and their affiliates (collectively “UNDP”) do not seek or solicit investment for programmes, projects, or opportunities described on this site (collectively “Programmes”) or any other Programmes, and nothing on this page should constitute a solicitation for investment. The actors listed on this site are not partners of UNDP, and their inclusion should not be construed as an endorsement or recommendation by UNDP for any relationship or investment.

The descriptions on this page are provided for informational purposes only. Only companies and enterprises that appear under the case study tab have been validated and vetted through UNDP programmes such as the Growth Stage Impact Ventures (GSIV), Business Call to Action (BCtA), or through other UN agencies. Even then, under no circumstances should their appearance on this website be construed as an endorsement for any relationship or investment. UNDP assumes no liability for investment losses directly or indirectly resulting from recommendations made, implied, or inferred by its research. Likewise, UNDP assumes no claim to investment gains directly or indirectly resulting from trading profits, investment management, or advisory fees obtained by following investment recommendations made, implied, or inferred by its research.

Investment involves risk, and all investments should be made with the supervision of a professional investment manager or advisor. The materials on the website are not an offer to sell or a solicitation of an offer to buy any investment, security, or commodity, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

Country & Regions

- South Africa: Countrywide

Sector Classification

Infrastructure

Development need

South South Africa faces significant challenges in achieving SDG 9 - Industry, Innovation and Infrastructure, with a score of 45.0. Scores for other goals include 48.7 for SDG 3 - Good Health and Wellbeing, 67.0 for SDG 6 - Clean Water and Sanitation, 79.0 for SDG 7 - Affordable and Clean Energy, and 77.9 for SDG 11 - Sustainable Cities and Communities.(1)

Policy priority

The National Planning Committee identified 9 primary challenges, 4 of which have infrastructure development needs and implications: the public health system cannot meet demand or sustain quality, the economy is unsustainably resource intensive, spatial divides hobble inclusive development, and infrastructure is poorly located, inadequate and undermaintained.(2)

Gender inequalities and marginalization issues

Poor infrastructure can exacerbate the gender gap. In low income countries, women collect over 70% of water and fuelwood. Women spend 200 million hours on water collection every day. Unsafe and low security transport also disadvantage women who are more affected by violence, which affects their wellbeing and workforce participation.(3)

Investment opportunities

President Ramaphosa has an investment drive to mobilise $100 billion for priority sectors, including the energy, water, transport and logistics, and data and ICT sectors.(4) The Sustainable Infrastructure Development Symposium South Africa organised by the Investment and Infrastructure Office within the Presidency seeks to create a $20.5 billion infrastructure fund.(5)

Key bottlenecks

High fixed costs, high levels of debt and low cash reserves may cause a liquidity crisis.(6) Construction was restricted during lockdown and sharp contractions of fixed investment can be expected as firms reconsider or postpone implementation.(7) Projects exposed to foreign currency risk foreign exchange fluctuations and further uncertainty if not previously hedged.(6)

Utilities

Development need

A major challenge for the South African government is to service rural populations where connection to the national grid is prohibitively expensive.(8) Distributed, off-grid, renewable energy sources (such as solar, wind and hydrogen) offer cost-effective solutions for overcoming the lack of access for the hardest-to-reach populations.

Policy priority

The National Development Plan (NDP) highlights South Africa's infrastructure development needs, including providing affordable and quality infrastructure in the energy, water, transport and logistics, data and ICT sectors. The South Africa National Infrastructure Plan highlights government aims to decarbonize the energy system and provide access to reliable clean electricity.(9)

Gender inequalities and marginalization issues

Women generally have less access to finance and energy-related services than men. Studies from Africa, for example, show that women-headed businesses generally face more impediments than men in accessing grid electricity.(10)

Investment opportunities introduction

As demand for hydrogen is building globally, the export potential of clean renewable hydrogen is also under scrutiny in South Africa. If South Africa could capture a 25% share of the estimated 800,000 ton/year hydrogen demand from Japan, this could generate USD 600 million a year.(11)

Electric Utilities and Power Generators

Pipeline Opportunity

Small scale energy infrastructure

Provide small scale renewable energy infrastructure to promote access to underserved communities, such as rooftop photovoltaic (PV) systems or off-grid hydrogen generators.

Business Case

Market Size and Environment

> USD 1 billion

The total available energy services market in South Africa is estimated to value R125 billion by 2035.

Small-scale embedded generation: 7.5 gigawatts (GW) of installed capacity by 2035, valued at R75 billion; Energy storage: conservatively estimated at R5 billion by 2035, but could reach up to R30 billion; Energy efficiency: R21 billion by 2035 (13)

Indicative Return

10% - 15%

Internal rate of return range: 11–21% based on the expert views (14)

Investment Timeframe

Medium Term (5–10 years)

Small-scale embedded generation: 5–10 year payback, current investment terms range from 5 to 15 years depending on the model (14); Energy storage: up to 15 years; Energy efficiency: 1-5 years (13)

Ticket Size

< USD 500,000

Market Risks & Scale Obstacles

Market - Highly Regulated

Business - Supply Chain Constraints

Capital - Limited Investor Interest

Impact Case

Sustainable Development Need

South Africa’s investment needs in energy infrastructure are vast. A major challenge for the South African government is to service rural populations where connection to the national grid is prohibitively expensive.(16) 3.5 million households still do not have access to electricity.(17)

Rural households face challenges due to their remote locations. Traditional models for off-grid electrification should be replicated across South Africa.(18) Local municipalities struggle to provide rural households with basic services, such as reliable electricity.(20),(18),(21),(16)

Many municipalities are attempting to tackle climate change and reduce their dependence on the national electricity utility (Eskom) by implementing clean off-grid energy technologies.(16)

Gender & Marginalisation

Energy poverty impacts women and children more severely than it does men, because women tend to do domestic chores such as cooking, cleaning and child care.(19)

Expected Development Outcome

Small-scale embedded generation (SSEG) offers municipalities opportunities to improve access and affordability of electricity services. It could also improve overall energy security.

Small-scale renewable energy infrastructure (such as rooftop photovoltaic (PV) systems) can also help facilitate and manage the provision of energy services to unserved and unserviceable communities.(22)

This investment opportunity area (IOA) can increase the provision of reliable, affordable and safe energy solutions to address basic needs, create jobs and promote socio-economic development.

Gender & Marginalisation

Improve energy security, decreasing the negative impact of the energy poverty on women

Primary SDGs addressed

1.4.1 Proportion of population living in households with access to basic services

Proportion of population living in households with access to: (i) improved sanitation facilities: 82.0%; (ii) improved electricity: 89.6%; (iii) improved water facilities: 86.4% in 2017.(20)

South Africa’s key poverty reduction program (2000) provides assistance to 17 million South Africans. In 2015 social grants covered 71.9% of all elderly persons and 92.2% of those classified as poor, one-third of households with children and 61.3% of poor households with children. Expenditures on social grants are expected to rise by 26% between 2016/17 and 2019/20.(26)

7.2.1 Renewable energy share in the total final energy consumption

7.1.1 Proportion of population with access to electricity

7.1.2 Proportion of population with primary reliance on clean fuels and technology

26.2% (2015) (28)

95.27% (2017) (26)

N/A

The Department of Energy (DoE) aspires to increase the share of renewable energy sources in the total national energy mix to 30% by 2025.(4)

N/A

The National Climate Change Response Policy White Paper identifies energy efficiency as one of South Africa's key flagship programs and a short term climate change mitigation measure. The White Paper promotes biofuels as another useful short term mitigation measure.(27)

Secondary SDGs addressed

Directly impacted stakeholders

People

Indirectly impacted stakeholders

Public sector

Outcome Risks

Installing the new infrastructure may cause a loss in biodiversity, and destruction of natural habitats and rural landscapes.

Impact Risks

Unexpected impact risk on environment

Impact Classification

What

The outcome is likely to be positive and important, by promoting infrastructure development for remote communities previously not connected to the power grid.

Who

Local communities - families and businesses, Local municipalities

Risk

Low risk

Impact Thesis

Improve access to clean energy and provide energy security in rural areas.

Enabling Environment

Policy Environment

Integrated Resource Plan 2019: This plan allows for 500 megawatts (MW) per year for distributed generation for own use of between 1 MW and 10 MW.(13)

National Energy Efficiency Strategy 2005, 2008, post 2015; Eskom unbundling plan 2019-2021

White Paper on Energy Policy of 1998: This paper supports the provision of secure, efficient and sustainable energy for socio-economic development.

Integrated Energy Plan 2010: This plan outlines the country’s broader energy needs.

Post-2015 National Energy Efficiency Strategy: This strategy guides the plan for energy-efficient buildings in South Africa by 2030.(3)

Financial Environment

Financial incentives: Property assessed clean energy (PACE) financing solves the upfront cost barrier by providing 100% financing for project costs. Long term repayment of up to 30 years makes longer payback projects immediately cashflow positive and buildings more valuable.(16)

Fiscal incentives: Tax deductible depreciation allowance in the year of installation and commissioning (23)

Other incentives: Pay As You Save allows utility customers to access cost-effective energy efficiency upgrades and distributed renewable energy assets regardless of income, credit history, or renter status. It is important for financing programs to serve hard-to-reach market segments.(13)

Regulatory Environment

Amendments to Schedule 2 of the Electricity Regulation Act 4 of 2006 on 10 November 2017: These regulations exempt small-scale power generators, wheelers and distributors (<1 MW) from obtaining a generation license.(3)

The National Energy Regulator of South Africa approved Eskom tariff increases of 9.41% (2020), 8.1% (2021), and 5.2% (2022).(13)

Energy reporting is mandatory for companies using 400 terajoules (TJ) or more.(13)

Carbon Tax Act (No 15 of 2019): This Act came into effect on 1 June 2019.

Marketplace Participants

Private Sector

Commercial banks (Amalgamated Banks of South Africa (ABSA), Nedbank, Standard Bank), Mergence, Development Bank of Southern Africa, South African Renewable Energy Business Incubator (SAREBI), PPC, Delft South and Ilitha Park

Government

Eskom, Provincial investment and trade agencies

Non-Profit

GreenCape, South African Renewable Energy Technology Centre

Target Locations

South Africa: Countrywide

References

- (1) Sachs, J., Schmidt-Traub, G., Kroll, C., Lafortune, G., Fuller, G., Woelm, F. (2020). The Sustainable Development Goals and COVID-19. Sustainable Development Report 2020. Cambridge: Cambridge University Press. https://dashboards.sdgindex.org/#/ZAF

- (2) National Science and Technology Forum (2019). The National Development Plan. http://www.nstf.org.za/wp-content/uploads/2019/04/All-The-NDP-1.pdf

- (3) Organization for Economic Cooperation and Development (2019). Gender Equality and Sustainable Infrastructure. http://www.oecd.org/governance/gender-equality-and-sustainable-infrastructure-paris-march-2019.htm

- (4) Industrial Development Corporation (2019). The Case For Investing in South Africa. https://sainvestmentconference.co.za/wp-content/uploads/2019/11/The-case-for-investing-in-South-Africa-2019-Executive-summary-31-October-2019.pdf

- (5) Sustainable Infrastructure Development Symposium (2020). Sustainable Infrastructure Development Symposium South Africa. https://sidssa.org.za/

- (6) Deloitte (2020). The Impact of COVID-19 on infrastructure projects and assets. https://www2.deloitte.com/content/dam/Deloitte/ng/Documents/finance/ng-the-Impact-of-COVID-19-on-Infrastructure-project-and-assets_27052020.pdf

- (7) Arndt, C., Davies, R., Gabriel, S., Harris, L., Makrelov, K., Modise, B., Robinson, S., Simbanegavi, W., van Seventer, D. and Anderson, L. (2020). Impact of Covid-19 on the South African economy. https://sa-tied.wider.unu.edu/sites/default/files/pdf/SA-TIED-WP-111.pdf

- (8) Bertha Centre for Social Innovation and Entrepreneurships (2019). Innovative Finance in Africa Review. https://www.gsb.uct.ac.za/Downloads/InnovativeFinanceAfrica_1.pdf

- (9) National Science and Technology Forum (2019). Series on the NDP. http://www.nstf.org.za/wp-content/uploads/2019/04/All-The-NDP-1.pdf

- (10) United Nations Development Programme (2016). Gender and Sustainable Energy Policy Brief. https://www.undp.org/content/dam/undp/library/gender/Gender%20and%20Environment/PB4-AP-Gender-and-Energy.pdf

- (11) Creamer, M. (2019). South Africa well placed to supply competitive hydrogen – CSIR. https://m.engineeringnews.co.za/article/south-africa-well-placed-to-supply-competitive-clean-hydrogen-csir-2019-08-28/rep_id:4433

- (12) Hydrox Holdings (2020). Unlock hydrogen. https://hydroxholdings.co.za/home/

- (13) GreenCape (2020). Energy Services Market Intelligence Report. https://www.greencape.co.za/assets/Uploads/ENERGY_SERVICES_MARKET_INTELLIGENCE_REPORT_20_3_20_WEB.pdf

- (14) Interview with Jack Radmore from GreenCape on the 24/07/2020.

- (15) Filipova, A and Morris, M. (2018). Small-scale embedded generation in South Africa: Implications for energy sector transformation from a local government perspective. https://sa-tied.wider.unu.edu/sites/default/files/WP-13-2018-Filipova.pdf

- (16) PACENation (2020). What is PACE financing? https://pacenation.org/what-is-pace/

- (17) Interview with Jack Radmore from GreenCape on the 07/07/2020.

- (18) GreenCape (2020). The alternative Service Delivery Unit. https://www.greencape.co.za/content/sector/the-alternative-service-delivery-unit

- (19) Heinrich Boell Stiftung (2016). Energy Poverty and Gender in Urban South Africa. https://za.boell.org/sites/default/files/status_quo_report_-_urban_energy_poverty_and_gender_in_south_africa-_final-1.pdf

- (20) Statistics South Africa (2019). Sustainable Development Goals: Country Report 2019 - South Africa. http://www.statssa.gov.za/MDG/SDGs_Country_Report_2019_South_Africa.pdf

- (21) Industrial Development Corporation (2019). The Case for Investing in South Africa. 2019. https://sainvestmentconference.co.za/wp-content/uploads/2019/11/The-case-for-investing-in-South-Africa-2019-Executive-summary-31-October-2019.pdf

- (22) GreenCape (2020). Wifi enabled solar street lights for Witsand: MoU signed between Think WiFi and GreenCape. https://www.greencape.co.za/content/wi-fi-enabled-solar-street-lights-for-witsand-mou-signed-between-think-wfi-and-greencape/

- (23) South African Alternative Energy Association (2019). We can help you link with funding for RE projects. https://www.saaea.org/renewable-energy-news/category/funding%20for%20renewables

- (24) National Planning Commission (2018). NPC Economy Series: Energy. https://www.gov.za/sites/default/files/gcis_document/201802/npc-energy-paper.pdf

- (25) Patel, M. (2020). OPINION: The role of small-scale embedded generation in energy resilience. https://www.iol.co.za/business-report/energy/opinion-the-role-of-small-scale-embedded-generation-in-energy-resilience-42654700

- (26) South African Government (2019). South Africa Voluntary National Review: Empowering people and ensuring inclusiveness and equality. https://sustainabledevelopment.un.org/content/documents/23402RSA_Voluntary_National_Review_Report___The_Final_24_July_2019.pdf

- (27) United Nations Development Programme (2020). Human Development Report. https://www.ng.undp.org/content/nigeria/en/home/library/human_development/the-2020-human-development-report.html

- (28) Statistics South Africa (2019). Sustainable Development Goals: Country Report 2019 - South Africa. http://www.statssa.gov.za/MDG/SDGs_Country_Report_2019_South_Africa.pdf